-Mr Mortgage

Jim Pendleton

ALL 50 States -

Affiliated Federal Bank

2023 Financial Services of America, LLC

JImPendleton NMLS 684537 ALL RIGHTS RESERVED

TYPES OF LOANS WE OFFER

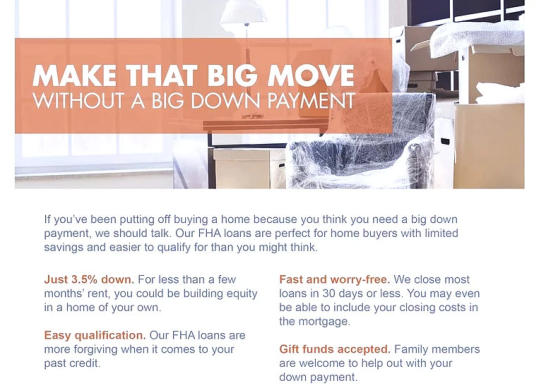

FHA (Federal Housing Authority)

JUMBO & SUPER JUMBO

VA Loans (Veterans Administration)

SONYMA is for NY residents only first time buyers, special down payment assistance available

NMLS 684537

o

Conventional Mortgages and SONYMA Mortgages

what is a mortgage broker

Mortgage broker

Intermediary who brokers mortgage loans on behalf of individuals or businesses

A mortgage broker acts as an intermediary who brokers mortgage loans on behalf of

individuals or businesses. Traditionally, banks and other lending institutions have

sold their own products. As markets for mortgages have become more competitive,

however, the role of the mortgage broker has become more popular. mortgage

broker

noun

1. a person or company that arranges mortgages between borrowers and

lenders: "get an independent mortgage broker to check the deal represents a

good rate"

find a mortgage broker

Connecting with an independent mortgage broker in your area means having a local

expert by your side for one of life's biggest financial decisions. Because they are

independent, licensed professionals, mortgage brokers can shop multiple lenders —

giving them access to more home loan options than what a bank or online lender can

offer. The result is a cheaper, faster and easier mortgage for you. One that is tailored to

your specific home financing needs. So, whether you're buying a home or refinancing,

find your perfect mortgage match by working with a mortgage broker.

free mortgage brokers

Initially most mortgage brokers are free, but you should always ask first, to be sure.

Independent mortgage brokers have a very unique edge that makes them very proficient in

service delivery. One advantage of using independent brokers is the array of information and

deals to which they have access. Because they transact with multiple lenders, they are well

connected and have in-depth knowledge about the ins and outs of brokerage service. It is

safe to say that the independent broker is connected to a large number of lenders; some are

connected to over twenty lenders. This variance gives you alternatives and the ability to

make choices that suit your best interests.

independent mortgage brokers

Independent mortgage brokers have a very unique edge that makes them very proficient in

service delivery. One advantage of using independent brokers is the array of information and

deals to which they have access. Because they transact with multiple lenders, they are well

connected and have in-depth knowledge about the ins and outs of brokerage service. It is

safe to say that the independent broker is connected to a large number of lenders; some are

connected to over twenty lenders. This variance gives you alternatives and the ability to

make choices that suit your best interests.

mortgage lenders vs banks

A mortgage lender is an institution that loans you money to buy a house. Of course, you’re

expected to pay the loan back with interest. That’s a given. But the basic idea is that a

mortgage lender makes it financially possible for you to buy a new home. Simple enough,

right? Your Bank is a Mortgage Lender. Your local bank is a mortgage lender.

first time home buyer grants

Grants and specialized loan programs for first-time home buyers are available in cities

and counties throughout the United States. These programs provide down payment and/or

closing cost assistance in a variety of forms, including grants, zero-interest loans, and

deferred payment loans. This is not a complete list, but it can serve as a starting point in

your search for the down payment assistance program or grant for your situation. A grant is

a loan, normally with no payment or interest due, until time or loan period passes. Typically,

10,15 year terms with the conditional rider that says you stay in the home until the time is

up, or you will owe the grantor the money back, minus the time you stayed in your home, all

conditions are disclosed before you are granted the funds.

mortgage broker lender

Mortgage Broker vs Bank. A mortgage broker has the ability to find the

best mortgage program through multiple lenders including large banks.

However, a bank will typically have just their own mortgage programs to

offer with fewer options than a broker. Final take on a Mortgage Broker vs

Small Lender vs Big Bank

broker vs direct lender

The mortgage industry is full of individuals and companies that help people get

access to financing for one of the biggest investments in their lives. These

entities include mortgage brokers and direct lenders. While they may provide

services to people seeking mortgage loans, they are very different. A mortgage

broker acts as an intermediary by helping consumers identify the best lender for

their situation, while a direct lender is a bank or other financial institution that

decides whether you qualify for the loan and, if you do, hands over the check.

lender vs bank

Broker vs Lender. The difference between a broker and a lender is that the

lender provides money to the debtor, whereas a broker is an agent who offers

the loan products provided by various investors. There are two types of lenders,

retail lenders and wholesale lenders. Those who commence with the loan

process themselves are called retailer, and those who hire contractors or

brokers are called wholesale lenders.

loan broker

A loan broker is a person that can help you find a loan or any type of financing

to get your business off the ground. They have built up years of connections

and have a deep network within this industry to find you the perfect loan.

mortgage broker vs mortgage lender

Mortgage Broker vs Bank. A mortgage broker has the ability to find the

best mortgage program through multiple lenders including large banks.

However, a bank will typically have just their own mortgage programs to

offer with fewer options than a broker. Final take on a Mortgage Broker vs

Small Lender vs Big Bank

real estate loan calculator

A mortgage is a loan secured by property, usually real estate property. Lenders

define it as the money borrowed to pay for real estate. In essence, the lender

helps the buyer pay the seller of a house, and the buyer agrees to repay the

money borrowed over a period of time, usually 15 or 30 years in the U.S. Each

month, a payment is made from buyer to lender. A portion of the monthly

payment is called the principal, which is the original amount borrowed. The

other portion is interest, which is the cost paid to the lender for using the money.

There may be an escrow account involved to cover the cost of property taxes

and insurance. The buyer cannot be considered the full owner of the mortgaged

property until the last monthly payment is made. In the U.S., the most common

mortgage loan is the conventional 30-year fixed-interest loan, which represents

70% to 90% of all mortgages. Mortgages are how most people are able to own

homes in the U.S.

what is a mortgage broker and more….click here

Active Member

2023 Financial Services of America, LLC -

Jim Pendleton NMLS 684537 ALL RIGHTS RESERVED